Shire of Donnybrook Balingup Financial Audit 2022 Findings

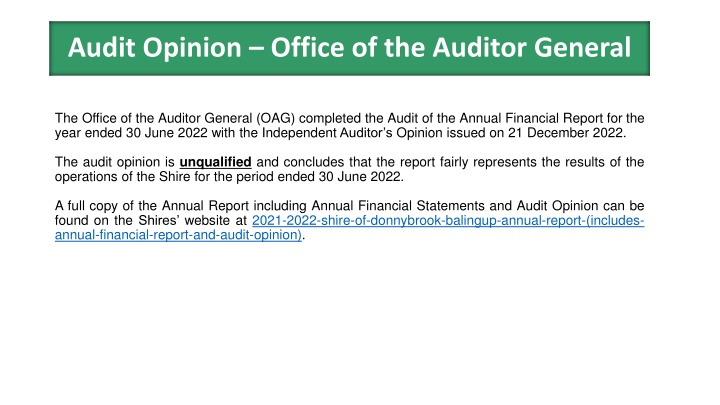

Explore the audit opinion by the Office of the Auditor General for the Shire's annual financial report ending June 2022. Details on operating income, expenditure, and variances are provided, highlighting key financial aspects and variances identified. Access the full report on the Shire's website.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Audit Opinion Office of the Auditor General The Office of the Auditor General (OAG) completed the Audit of the Annual Financial Report for the year ended 30 June 2022 with the Independent Auditor s Opinion issued on 21 December 2022. The audit opinion is unqualified and concludes that the report fairly represents the results of the operations of the Shire for the period ended 30 June 2022. A full copy of the Annual Report including Annual Financial Statements and Audit Opinion can be found on the Shires website at 2021-2022-shire-of-donnybrook-balingup-annual-report-(includes- annual-financial-report-and-audit-opinion).

2021/22 Operating Income $18,327,521 12,000,000 10,000,000 8,000,000 6,122,936 6,000,000 5,333,239 4,892,961 4,000,000 1,750,780 2,000,000 130,482 80,288 16,835 0 Operating grants, subsidies and contributions Non-operating grants, subsidies and contributions Rates Fees and charges Interest earnings Other revenue Profit on asset disposals 2022 Actual $ 6,122,936 5,333,239 1,750,780 80,288 16,835 4,892,961 130,482 2022 Actual % 33.4% 29.1% 9.6% 0.4% 0.1% 26.7% 0.7% 2022 Budget $ 6,110,565 2,432,997 1,582,087 104,000 400 11,389,111 24,018

2021/22 Operating Income Variances: Operating grants, subsidies and contributions over $2.9m. Prepayment of Financial Assistance Grants for the 2022/2023 Financial Year of $1.571m and MRWA Clay Soil donation (Non-Cash) valued at $1.65m. Non-operating grants, subsidies and contributions under $6.49m VC Mitchell Grant $4.36m, Bridge Grants $1.5m and Road Grants $607k.

2021/22 Operating Expenditure $17,413,659 (7,000,000) (6,000,000) (5,000,000) (4,000,000) (3,000,000) (2,000,000) (1,000,000) 0 1,000,000 Materials and contracts Depreciation on non- current assets (Loss) on asset disposals Employee costs Utility charges Amortisation Interest expenses Insurance expenses Other expenditure 2022 Actual $ (5,701,415) (3,036,481) (402,382) (5,711,771) (530,249) (11,494) (377,200) (235,470) (1,407,197) 2022 Actual % 32.7% 17.4% 2.3% 32.8% 3.0% 0.1% 2.2% 1.4% 8.1% 2022 Budget $ (5,597,803) (3,714,673) (379,610) (5,758,977) 0 (12,372) (367,996) (209,599) (28,303)

2021/22 Operating Expenditure Variances: Employee Costs $103k over. Movement in employee leave provisions. Materials and Contracts under $678k Noxious Weed program $350k, Bridge Mtc $85k, Street Cleaning $62k, Organic Refuse $45k Bushfire Mitigation $137k. Depreciation (Non-Cash) over $483k Revaluation of Assets. Loss on Disposal of Assets (Non-Cash) over $1.38m DBK Country Club $1m, Donnybrook Depot $205k, Balingup Depot $43k.

2021/22 Operating Net Result The Net Result of ordinary operations was $913,862. An adjustment for changes in asset revaluation surplus of $14,181,440 due to the revaluation of Land and Buildings, this is not a cash adjustment. The total Comprehensive Income reported for the Year was $15,095,302.

Adjusted Operating Results Available Cash from Operations attributable to 2021/22 Actual Result 2022 $ 6,122,936 Adjustments: Revenue Non Cash Items Rates (130,482) Operating grants, subsidies and contributions 5,333,239 Profit on asset disposals Fees and charges 1,750,780 1,407,197 (Loss) on asset disposals Interest earnings 80,288 5,711,771 Depreciation on non-current assets Other revenue 16,835 530,249 4,892,961 Amortisation Non-operating grants, subsidies and contributions 130,482 Profit on asset disposals 7,518,735 18,327,521 Income for Capital Works (4,892,961) Non-operating grants, subsidies and contributions 2022 $ (5,701,415) Expenses Employee costs Other comprehensive income Materials and contracts (3,036,481) (14,181,440) Utility charges (402,382) Changes in asset revaluation surplus Depreciation on non-current assets (5,711,771) Amortisation (530,249) 3,539,636 Net Cash from Operations Interest expenses (11,494) Insurance expenses (377,200) Other expenditure (235,470) (1,571,428) (1,407,197) (Loss) on asset disposals Less Prepayment of Financial Assistance Grants attributable to 2022/2023 (17,413,659) 913,862 Net result for the period Other comprehensive income 1,968,208 14,181,440 Available cash from Operations for use in Capital Works or Transfers to Reserve Changes in asset revaluation surplus 14,181,440 Total other comprehensive income for the period 15,095,302 Total comprehensive income for the period

2021/22 Capital Expenditure Total Expenditure of $6.26m: 3,500,000 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 0 1 2 Infrastructure - Roads 2,873,898 45.9% Infrastructure - Other 2,124,638 33.9% Infrastructure - Footpaths 102,277 1.6% Infrastructure - Work in Progress Movement 181,166 2.9% Land and Buildings 681,749 10.9% Furniture and Equipment 23,166 0.4% Plant and Equipment 261,632 4.2% PPE Work in Progress - Movement 11,136 0.2%

2021/22 Capital Expenditure Variances Underspend to Budget: VC Mitchell Park $5.86m, Bridge Works MRWA $1.5m, Road Works $607k, and Plant Purchases $228k.