Understanding Contract Costing Methods in Construction Projects

Contract costing is a method used in construction, building, and maintenance projects to determine the cost of work undertaken on a contract basis. Learn about the features of contract costing, differences from job costing, and how profits are calculated for completed and incomplete contracts.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

CONTRACT COSTING Contract costing is method of costing applied to ascertain the cost of a work undertaken on a contract basis. It is used by concerns engaged in building, construction, plant erections, repairs and maintenance.

FEATURES OF CONTRACT COSTING: Contracts are jobs requiring longer period. Each contract is treated as a separate cost unit for the purpose of determination and cost control. Contracts are executed as per the specifications given by the contractee. The consideration the contractee has to pay to the contractor for executing the contract is known as contract price. Since the work is undertaken at the contract site, most of the items of cost chargeable to contracts are direct in nature.

DIFFERENCE BETWEEN CONTRACT COSTING AND JOB COSTING. Contract costing Job costing. Contract is bigger in size. Hence, it takes more time to complete. Job is small in size, it takes less time to complete. Contract work is executed outside the premises of the contractor. Job work is executed at the premises of the contractor. Contract price is paid in installments depending upon the progress of work. The price of the job is paid in full after completing the job. Most of the expenses incurred in execution of the contract are direct in nature. Since a number of jobs are executed simultaneously in the factory. Pricing is influenced often by specific clause of the contract. Job price is decided on the basis of pricing policy of the manufacturer.

PROFIT ON CONTRACT In case of contract started and completed within one accounting period: 1) Difference between contract price and the expenses debited to contract account represents the profit (or loss) and it is transferred tp profit and loss account..

2) IN CASE OF INCOMPLETE CONTRACT: Contracts just commenced: under such situations the entire amount of notional profit is carried forward as reserve for future contingencies.So, when work certified is less than of the contract price, no profit transferred to P/L account. a) Work certified is one fourth or more than one fourth but less than half of the contract price: In such case one third of the notional profit is transferred to profit and loss account. b) Notional profit*1/3*cash received/ work certifie

c) Work certified is more than half of the contract price: = Notional profit*2/3*cash received /work certified. d) Loss on incomplete contracts: the entire amount of loss on the incomplete contract must be charged to profit and loss account of the concerned accounting year.

OPERAING COSTING The cost of providing a service is known as operating cost. The method used for ascertaining the cost of a service is known as servce costing or operating costing. ICMA defines costing as that form of operation costing which applies where standardized services are provided either by an undertaking or by a service cost Centre with in an undertaking.

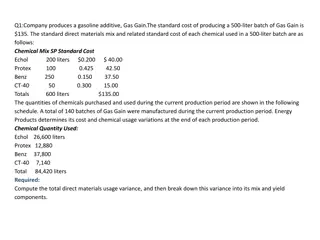

TRANSPORT COSTING: Total passenger kilometer: =distance covered (km./ mile)*number of passengers carried*trips*number of vehicle*days. Total ton kilometer: =distance covered (km./ mile)* tons carried* trips*number of vehicles*days. or = distance covered*carrying capacity*capacity utilized* number of trips* number of vehicles*availability of vehicles* days.

FORMAT OF OPERATING COSTING: Total cost cost per passenge Fixed cost: wages of driver, conductor, cleaner, Wages of mangers,accountant, clerk. Salary of supervisor, manager, accountant. Insurance premium. License fees. Road tax. Garage rent, Permit fees. Supervision charges. Office and administrative overhead. Workshop expenses, stationary, cost of tyre, tube etc. Less: sale of old tyre, tube etc., if any Total fixed cost Fixed cost per passenger/ton km (total fixed charges passenger/ ton km) Variable cost: Depreciation Repairs and maintenance charges. Diesel or petrol Total operating cost per passenger/ton km. *** *** *** *** *** *** *** *** *** *** *** **** *** *** *** ***