Understanding IRS Reporting Requirements under Codes 6055 and 6056

Learn about the IRS reporting responsibilities under Codes 6055 and 6056, including details on Minimum Essential Coverage (MEC) reporting, Applicable Large Employer (ALE) reporting, filing matrix responsibilities, IRS forms 1094 and 1095, and MEC reporting and filing procedures. Stay compliant with the latest regulations to ensure a smooth reporting process.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Get Ready.Get Set.Report! Reporting Under Code 6055 and 6056 IRS Circular 230 Disclosure: To insure compliance with Treasury Regulations, we are required to inform you that any tax advice contained in this communication (including any attachments) was not intended or written by us to be used, and may not be used by you or anyone else, for the purpose of: (i) avoiding penalties imposed by the Internal Revenue Code; or (ii) promoting, marketing, or recommending to another party any tax- related matter addressed in this communication. Presented by: Darcy L. Hitesman Hitesman & Wold, P.A.

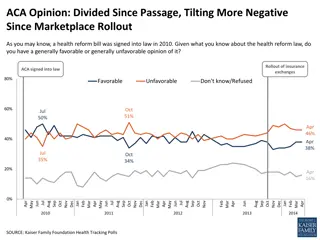

Do you have to file? Two new reporting requirements beginning in 2016 Caution: Based on 2015 calendar year data. Reporting requirement not tied to whether penalty assessable in 2015 Minimum Essential Coverage (MEC) Reporting Code 6055 Completed by any person providing MEC To facilitate enforcement on individual mandate Applicable Large Employer (ALE) Reporting Code 6056 Completed by an ALE (special rule for controlled groups and governmental entities) To facilitate enforcement of Employer Shared Responsibility (a/k/a Play or Pay)

Filing Matrix FILING RESPONSIBILITIES UNDER SECTIONS 6055 & 6056 PLAN TYPES Insured Self-Insured ALE Employer files as large employer Insurance carrier as provider of MEC Employer files as large employer Employer as provider of MEC EMPLOYER SIZE NOT-ALE Employer does not file as large employer Insurance carrier as provider of MEC Employer does not file as large employer Employer as provider of MEC * rare situation

IRS Forms Two separate requirements but not as simple as separate forms for each requirement Form 1094 Transmittal Form 1095 Particular Employee Information Goal today: Familiarity with forms and appreciation for information required.

MEC Reporting/Filing Who files if insured? Insurance carrier What forms? With whom? Form 1094-B Form 1095-B IRS Covered employee

MEC/Reporting Filing Who files if self-insured? Plan administrator (employer for single employer plan) What forms? With whom? Form 1094-C* Form 1095-C* IRS Covered employee * or series B if not insured and not an ALE

ALE Reporting/Filing Who files? Employer files as ALE. What forms? With whom? Form 1094-C Form 1095-C IRS Covered employee

Focus on Series C Just ALEs In General ALE completes Series C 1094-C Transmittal 1095-C Particular Employee Information

Which Forms & What Parts ALE Scenarios: Type of Employer: Type of Coverage: Required Forms: ALE None 1094-C 1095-C (Parts I and II) Type of Employer: Type of Coverage: Required Forms: ALE Fully insured medical coverage B series completed by insurance carrier 1094 -C 1095 - C (Parts I and II) Type of Employer: Type of Coverage: Required Forms: ALE Self-insured medical coverage 1094-C 1095-C (Parts I, II, III)

Which Forms & What Parts Non-ALE Scenarios: Type of Employer: Not ALE Type of Coverage: None Required Forms: None Type of Employer: Type of Coverage: Required Forms: Not ALE Fully insured medical coverage B series completed by insurance carrier No series C Type of Employer: Type of Coverage: Required Forms: Not ALE Self-insured medical coverage B series completed by employer No series C

Select Aspects of Series C Form 1094 C Transmittal (see handout) Part I ALE identification information Line 7. Contact person

Select Aspects of Series C Lines 8 16. Designated Governmental Entity (DGE) Line 18. Number of accompanying 1095 Forms Part II ALE workforce information Line 19. Authoritative transmittal Line 21. Controlled group identification

Controlled Group Situations Controlled group rules 414 of Code If related to sufficient degree, treated as single employer Apply to determine ALE status DO NOT APPLY for 6055, 6056 reporting One controlled group member can file and provide on behalf of others Special rule for governmental employers; permits another governmental entity to report on behalf Each controlled group member files with respect to own employees.

Select Aspects of Series C Part II (cont.) Line 22. Types of transitional relief (see handout) Qualifying Offer 2015 Qualifying Offer Method Transitional Relief Section 4980H Transitional Relief 98% Offer Method Note: Selections here correlate to information required later on the 1095-C Examples of internal coordination If select the 98% offer method, instructions provide not required to complete Part III, column (b) Full-Time Employee If select Section 4980H Transitional Relief, instructions provide must complete Part III, column (e) and indicate type of relief Signature line Under penalties of perjury

Select Aspects of Series C Part III, lines 23 - 35 Column a. Minimum Essential Coverage (MEC) Column b. Full-time employee count (full-time for purposes of HCR); excludes those in Limited Non- assessment Period (LNP) LNP The instructions provide that A Limited Non-Assessment Period generally refers to a period during which an ALE Member will not be subject to an assessable payment . . . regardless of whether that employee is offered health coverage during that period. Examples: initial measurement period; waiting period.

Select Aspects of Series C Part III, lines 23 35 (cont.) Column c. Total employee count (all employees) Column d. Aggregated group indicator (controlled groups) Column e. Section 4980H transition relief indicator Part IV Controlled group information

Select Aspects of Series C Form 1095 C Particular Employee Information Part I. Employee information Line 2. Social Security No. Part II. Offer and Coverage All months; each month Line 14. Offer of coverage Line 15. Employee cost, single coverage, lowest cost option Line 16. Pay Safe Harbor being used

Select Aspects of Series C Part III. Covered Individuals IMPORTANT: Only complete if self-insured coverage Lines 17-22. Persons covered through the employee. Column a. Name Columns b or c. Social Security No. (or birthdate) Column d or e. All 12 months; each month Instructions for Recipient

Timing of Filing & Notices Note: All based on calendar year; no accommodation for non-calendar plan years Information reported once for the calendar year But information reported for each calendar month (unless exception applies) Penalty assessments each month Whether violation Amount of penalty

Timing of Filing & Notices Forms 1094 - C and 1095 - C to IRS Due last day of February following calendar year If electronically filed, due March 31 250 or more of same form requires electronic filing Form 1095 - C to employee By January 31 of following calendar year Same timing as W-2 Include Instructions for Recipient

Suggestions Identify the right person Know what you offer, including details Track information Calendar key compliance deadlines

Suggestions Whether complete annual filing in house or use outside vendor, need to have a knowledgeable person assigned the responsibility for filing Based on employer specific information Provides IRS with information necessary to determine and impose penalties Provides information relied upon to determine whether individual tax subsidy available

Suggestions Need to have the information in order to mine the information Not going to happen by accident Whatever was in place pre-HCR likely not enough Payroll (finance) Benefits Other Tracking systems for HCR information Already in place Process of being put in place

Questions 24

Thank you Darcy L. Hitesman Hitesman & Wold, P.A. 12900 63rd Avenue North Maple Grove, MN 55369 763-503-6620 Visit our website to register to receive our informational Client Alerts! www.HitesmanLaw.com