Understanding Service Tax Reverse Charge Mechanism Rules

Learn about the rules and regulations pertaining to the reverse charge mechanism in service tax. Discover how to handle payments to service providers and the implications of delayed payments. Get insights into handling input service tax credits effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

CA NITIN GUPTA Email : nitin.gupta52@yahoo.com Download www.taxguru.in

IN CASE OF SERVICE RECEVIER IN CASE OF REVERSE CHARGE WHERE PAYMENT IS MADE TO THE SERVICE PROVIDER, WITHIN 6 MONTHS FROM THE DATE OF INVOICE POT = PAYMENT BASIS WHERE PAYMENT IS NOT MADE TO THE S.P., WITHIN 6 MONTHS FROM THE DATE OF INVOICE POINT OF TAXATION RULE ARE APPLICABLE

IN CASE OF SERVICE RECEVIER CRR ON INPUT SERVICE SERVICE TAX AMOUNT PAYABLE TO SERVICE PROVIDER(PARTIAL PAYABLE AMOUNT OF SERVICE TAX) PAYMENT MADE TO DIRECT DEPARTMENT ON OR AFTER THE DAY OF RECEIPT OF INVOICE ON PAYMENT OF VALUE OF SERVICE AND SERVICE TAX PROVIDED THAT IF PAYMENT OF VALUE & SERVICE TAX NOT MADE WITHIN 3M OF THE DATE OF INVOICE THEN PAYMENT MADE TO DEPARTMENT EQUAL TO CRR AVAILED (DEBITING CCR OR PLA) PROVIDED FUTHER THAT IF PAYMENT MADE AFTER 3M THEN SERVICE RECEVIER CAN TAKE CREDIT WHICH WAS PAID EARIER

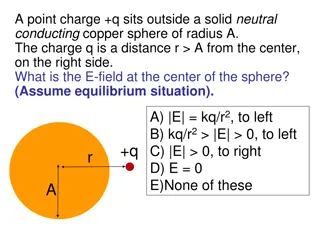

EXAMPLE Services by way of supply of manpower for any purpose or security services Service Provided by Individual, HUF, partnership firm whether registered or not or AOP; which are located in taxable territory = 25 % Service Receiver - Any business entity registered as body corporate and located in taxable territory = 75% Body corporate here means as defined in section 2(7) of the Companies Act, 1956 [Rule 2(1)(bc) of the Service Tax Rules]

Value of service provided by an individual N 100000 Service provider 25% Service receiver 75%

BILLING SYSTEM BILLING DONE BY SERVICE PROVIDER GROSS VALUE(LABOUR CHARGES) (25% ON LAB. CHARGES i.e.25000) S.TAX EDU. CESS SEC. CESS TOTAL 100000 3000 60 30 103090

AT THE TIME OF BILL RECEIVE FROM SERVICE PROVIDER EXPENSE A/C CRR ON INPUT SERVICE(ST) A/C CRR ON INPUT SERVICE(EDU CESS) CRR ON INPUT SERVICE(SEC CESS) TO SERVICE PROVIDER (N) (Being bill have been issued and received) DR. 100000 DR. 3000 DR. 60 DR. 30 103090

AT THE TIME OF PAYMENT MADE TO SERVICE PROVIDER SERVICE PROVIDER (N) A/C DEFERRED CRR ON INPUT SERVICE(ST) A/C DR. 9000 DEFERRED CRR ON INPUT SERVICE(EDU CESS) DR. 180 DEFERREDCRR ON INPUT SERVICE(SEC CESS) TO BANK TO SERVICE PAYABLE A/C(ST) TO SERVICE PAYABLE A/C (EDU CESS) TO SERVICE PAYABLE A/C (SEC CESS) (Being payment made to service provider and as per rule-7 of POT service tax liability due) DR 103090 DR. 90 103090 9000 180 90

AT THE TIME OF PAYMENT MADE TO DEPARTMENT PAYMENT ENTRY SERVICE PAYABLE A/C(ST) SERVICE PAYABLE A/C (EDU CESS) SERVICE PAYABLE A/C (SEC CESS) TO BANK A/C (Being service tax liability paid) DR. DR. 180 DR. 9000 90 9270 CRR BOOK ENTRY CRR ON INPUT SERVICE(ST) A/C CRR ON INPUT SERVICE(EDU CESS) CRR ON INPUT SERVICE(SEC CESS) TO DEFERRED CRR ON INPUT SERVICE(ST) A/C TO DEFERRED CRR ON INPUT SERVICE(EDU CESS) TO DEFERREDCRR ON INPUT SERVICE(SEC CESS) (Being CCR Book as per Rule 4(7) of CCR rule 2004) DR. DR. DR. 9000 180 90 9000 180 90