Understanding Tax Evasion and Low Tax to GDP Ratio in Nigeria

Explore the prevalence of tax evasion in Nigeria and the country's low tax to GDP ratio compared to other nations. Discover the effects, reasons, and solutions to tax evasion, along with strategies to improve the tax collection rate in Nigeria.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

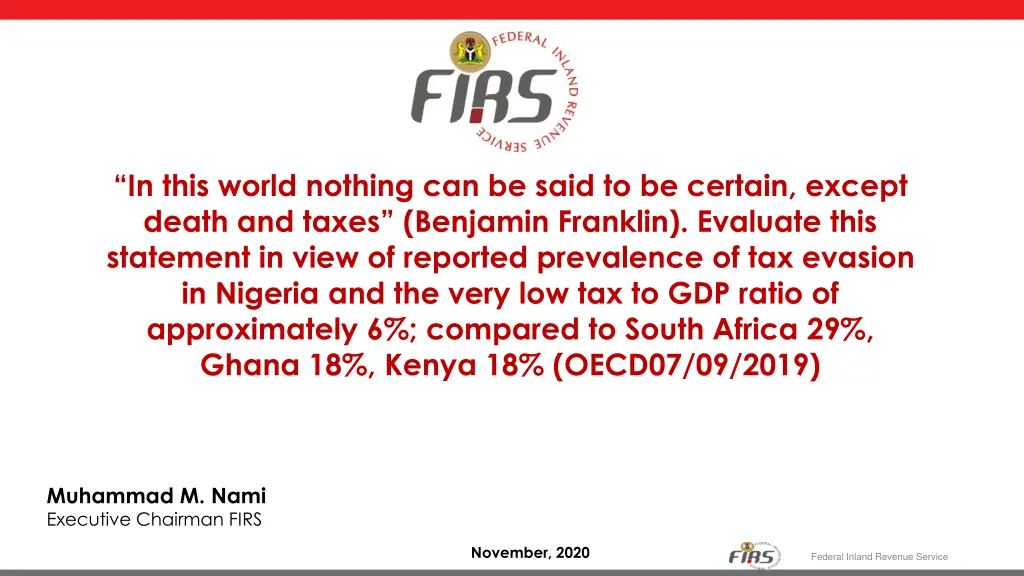

In this world nothing can be said to be certain, except death and taxes (Benjamin Franklin). Evaluate this statement in view of reported prevalence of tax evasion in Nigeria and the very low tax to GDP ratio of approximately 6%; compared to South Africa 29%, Ghana 18%, Kenya 18% (OECD07/09/2019) Muhammad M. Nami Executive Chairman FIRS November, 2020 Federal Inland Revenue Service FRC Stakeholder s Forum

Outline o Introduction o Tax Evasion and the low tax to GDP ratio o Effects of Tax Evasion in Nigeria o Reasons for Tax Evasion in Nigeria o Curbing Tax Evasion in Nigeria o Improving tax to GDP ratio in Nigeria o Conclusion Federal Inland Revenue Service FRC Stakeholder s Forum

Introduction Everyone dies, and the essential expenditures of government must be financed through taxation Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 3 Federal Inland Revenue Service FRC Stakeholder s Forum

Introduction Just as the time of death is not certain, the burden of tax is equally not definite Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 4 Federal Inland Revenue Service FRC Stakeholder s Forum

Introduction Tax evasion is a form of fiscal corruption and has been a persistent problem throughout history with serious economic consequences Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 5 Federal Inland Revenue Service FRC Stakeholder s Forum

Tax Evasion and the low tax to GDP ratio (Contd) Comparative data shows that Nigeria is lagging behind in the percentage of GDP collected as tax. 6% NIGERIA 34% OECD AVERAGE 12.8% BRAZIL 16% INDIA 18% KENYA 18% GHANA 29% SOUTH AFRICA Despite the fact that Nigeria has some of the most profitable and well capitalized companies in Africa, tax remittance rate is still very low. Our tax to GDP ratio remains the lowest in Africa and one of the lowest in the world at 6%. Compared to South Africa s 29%, Ghana 18%, and Kenya 18% (OECD07/09/2019) 6 Federal Inland Revenue Service FRC Stakeholder s Forum

Tax Evasion and the low tax to GDP ratio Economically Active People of 69.9 51.9 To be Registered 18 Registered Taxpayers Joint Tax Board, Oct. 2020, Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 7 Federal Inland Revenue Service FRC Stakeholder s Forum

Tax Evasion and the low tax to GDP ratio (Contd) Manipulation of Accounting Records Registration of assets in nominee names complex structures for transactions, Tax Evasion Mechanism Offshore companies in tax havens Non- registration for VAT Transfer of assets overseas Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 8 Federal Inland Revenue Service FRC Stakeholder s Forum

Effects of Tax Evasion in Nigeria Tax evasion has very dire effects on the Nigeria economy as it Undermines state, institutions, & regulatory capacities Weakens good governance Contributes to political discontent Deepens reliance on donors and creditors Leads to unequal burden of citizenship Effort to curb tax evasion strains the already weak capacities Contributes to shifting resources 9 Federal Inland Revenue Service FRC Stakeholder s Forum

Reasons for Tax Evasion in Nigeria Complex fiscal structure Large informal sector Corruption Poor Identity Management System Capacity to enforce compliance Paucity of human capital Complexity of tax laws Opportunities Deterrence Tax burden Compliance costs Benefits of registering as taxpayer Affordability Inefficient utilization of tax revenue Overdependence on Oil revenue Perception of tax system Personal norms Social norms Tax Morals Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 10 Federal Inland Revenue Service FRC Stakeholder s Forum

Curbing Tax Evasion in Nigeria Nigeria is taking bold step aimed at preventing, detecting and deterring tax fraud and outright tax evasion. Compliance and Enforcement International Tax Initiatives ICT Initiatives Tax Amnesty Programmes Other Initiatives Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 11 Federal Inland Revenue Service FRC Stakeholder s Forum

FIRS QUICK WINS Engaged more tax officers Motivation of existing tax officers Staff Repositioned International Tax Department. Upgraded Special Tax Audit to a Department Increased number of: Tax offices Tax Audit Offices Tax Investigation Divisions Collaboration with stakeholders Passage of 2019 Finance Act. 2020 FA in-progress System Structure 12 Federal Inland Revenue Service FRC Stakeholder s Forum

Improving tax to GDP ratio in Nigeria Increased use of Technology Improved Communication FIRS Specific Actions Taxpayers Registration Improved Collaboration Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 13 Federal Inland Revenue Service FRC Stakeholder s Forum

Improving tax to GDP ratio in Nigeria (Contd) 17% 2023 Citizens Identity Management System Financial Inclusion initiative of the Central Bank of Nigeria Automation of government business process Bank Verification Number (BVN) FIRS Initiatives earlier mentioned 6% 2019 Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 14 Federal Inland Revenue Service FRC Stakeholder s Forum

Conclusion Taxes must be paid to support Government Expenditure Many economically active people are yet to be in the tax net Tax evasion is a crime and must be reduced, if not eliminated Nigeria is doing something to grow her tax to GDP ratio There is still much to be done Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 15 Federal Inland Revenue Service FRC Stakeholder s Forum

Every Generation Of People Owe The Next Generation A Debt. This is Paid By Ensuring That We Provide Means For The Next Generation To Survive. - Prof. Yemi Osibanjo Keynote Paper at the 3rd Annual Conference on Financial Fraud, Electoral Fraud and Cross-Border Crime 16 Federal Inland Revenue Service FRC Stakeholder s Forum

Feedback! 17 Federal Inland Revenue Service FRC Stakeholder s Forum