US Trade Agreements: Entry, Classification, and Labeling Requirements

Explore the essential aspects of US trade agreements such as entry determinations, classification rules for handicrafts, labeling requirements, and general preferences programs like GSP and AGOA.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

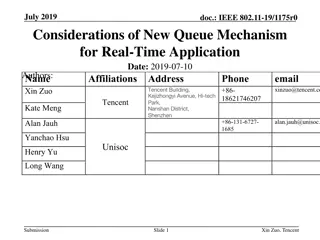

Taking Advantage of U.S. Trade Agreements Jan Forest Customs Attorney/Consultant Washington, DC Tel: (202) 841-1060 jan@jforestconsulting.com July 11, 2019

Determinations Required for Entry Classification determines Admissibility Rate of Duty Eligibility for Preferences Valuation Country of origin Admissibility 2

Classification of Handicrafts General rule is to classify the item without regard to it s description as handicraft or folklore Classify as shirt, basket, wood article, etc. Classify as handicraft only if specifically approved under a trade preference program such as CBI or AGOA Handwoven, handmade, folklore, ethnic fabric may be free of duty under AGOA The article must be specifically approved by USTR to qualify

Labeling requirements Country of origin marking Every article of foreign origin must be legibly marked with the English name of the country of origin prior to shipment unless an exception from marking is provided Special labeling rules for Agricultural commodities Ceramics Consumer products (appliances, toys, etc.) Electronic products Food, drugs and cosmetics Textiles, wool and fur 4

General Requirements for Preference Programs Country must be eligible Product must be eligible Must be imported directly Must meet requirements of origin rules

Generalized System of Preferences (GSP) GSP provides preferential treatment to around 5,000 products from 129 designated beneficiary countries, including 47 least-developed countries (33 in Africa) List of countries (General Note 4(a) to HTSUS) Eligible products indicated by A (all GSP countries), A* (certain ineligible countries) or A+ (only LDBDCs) in Special Column of HTSUS Excludes textiles and apparel; watches; import-sensitive electronics, steel and glass; footwear; agricultural (over quota) Origin requirement (growth, product or manufacture plus no less than 35% of U.S. entered value made up of materials plus direct costs of processing from beneficiary country)

African Growth and Opportunity Act (AGOA) AGOA based on GSP law, but covers more products than GSP List of countries (General Note 16(a) to HTSUS) Objectives: Expanding U.S. trade and investment with sub-Saharan Africa, stimulate economic growth, economic integration 2018 AGOA imports: $11.1 billion; 69.74%petroleum oils. Top suppliers: Nigeria, South Africa, Angola, Chad , and Kenya.

AGOA Rules of Origin Non-textile products Indicated by D in Special Column of HTSUS Origin requirement (growth, product or manufacture plus no less than 35% of U.S. entered value made up of materials plus direct costs of processing from beneficiary country; can be 15% U.S.) Textiles and wearing apparel Requirements for textiles and wearing apparel in Chapter 98 of the HTSUS Does not require 35% value added in AGOA country Does require additional documents AGOA Certificate of Origin Invoice stamped with original AGOA visa Written declaration of Chapter 98 subheading on entry documents

North American Free Trade Agreement (NAFTA) Countries: US, Canada and Mexico Product indicator: CA or MX Origin rule: Change in heading rule Objectives: Freer markets, fairer trade, robust economic growth Top imports: agriculture, textile, automobiles and parts

U.S- Chile Free Trade Agreement (FTA) Product indicator: CL Origin rule: Change in heading rule Objectives: Freer markets, fairer trade, robust economic growth Top imports: copper, grapes, citrus

US-Colombia Trade Promotion Agreement Product indicator: CO Origin rule: Change in heading rule Objectives: Freer markets, fairer trade, robust economic growth Top imports: The main imported product in 2018 was petroleum oils representing 55.70%

Israel Product indicator: IL Origin rule: growth, product or manufacture plus no less than 35% of U.S. entered value made up of materials plus direct costs of processing from beneficiary country; can be 15% U.S. Objectives: expand trade and investment in order to reduce barriers and promote regulatory transparency. Top imports: precious metal, pharmaceutical, electrical machinery optical and medical instruments.

Morocco Product indicator: MA Origin rule: growth, product or manufacture plus no less than 35% of U.S. entered value made up of materials plus direct costs of processing from beneficiary country; some products subject to change in heading rule Objectives: duty free access to the Moroccan market, commitments by Morocco for increased regulatory transparency and the protection of property rights, the FTA covers more than 95% of all goods and services. Top imports: fertilizers, electrical machinery, woven apparel.

Nepal Product indicator: NP Origin rule: growth, product or manufacture plus no less than 35% of U.S. entered value made up of materials plus direct costs of processing from beneficiary country; can be 15% U.S. Objectives: expansion of trade, investment and technical cooperation and strengthening economic relations. Top Imports: carpets and other textile covering, art and antiques, food waste.

Panama Product Indicator: PA Origin rule: change in heading Objectives: elimination of tariffs and removes barriers to U.S. services including financial services. TopImports: special other (repairs), fish and seafood, mineral fuels.

Peru Product indicator: PE Origin rule: change in heading Objectives: eliminates tariffs and remove barriers to U.S. services, provides a secure legal framework for investors, and strengthens protection for intellectual property. Top imports: precious metal and stone, edible fruits and nuts (grapes), and mineral fuels.