Workers in China: Post-Crisis Employment Trends

Explore the post-crisis changes in China's labor market, including rising wages for migrants, urban labor market informalization, enforcement of labor regulations, and key employment challenges. Discover insights from official data, firm surveys, and household surveys, shedding light on the evolving landscape of workers in China.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Albert Park, University of Oxford, CEPR, and IZA Fang Cai and Yang Du, Chinese Academy of Social Sciences John Giles, World Bank and IZA

Document and interpret what happened to workers in China since the crisis Official data Firm surveys (PBC-CASS enterprise survey 2009) Household surveys (China Urban LaborSurvey 2010) Discuss key employment challenges moving forward Labor market shortage? Enforcement of laborregulations Labor market informality

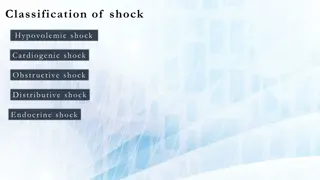

Rising real wages for migrants since 2005 (reaching double digit increases) Steady increases in rural-urban migration (145 million individual migrants in 2009) Rapid informalization of the urban labormarket (by 2005, >50% of urban workers were employed informally) China implemented a landmark LaborContract Law starting on January 1, 2008 Growth slowdown started in early 2008, before the crisis

100.0 90.0 80.0 70.0 60.0 Public 50.0 Non-public Self-employed 40.0 Unregistered 30.0 20.0 10.0 0.0

By keeping workers off the books, employers can avoid payroll taxes for social insurance programs (equal to 27% (18%) of wages for local (migrant) workers). Young workers may prefer cash wages to social insurance coverage, esp. when benefits are not portable Rise of the private sector (harder to monitor and regulate) Massive inflow of migrants (less concern about protections for migrants)

LaborContracts After 2 fixed-term contracts, or 10 years of employment, contract must be open-ended Limits on probationary period (1-3 months depending on contract length) Regulations on temporary work agencies (labor service companies Severance conditions 30-day written notice Severance pay: one month s pay for each year of service (half month s pay if less than 6 months), double severance pay for unfair dismissal

Quarterly on Quarterly Growth by Sector (%) 18 GDP Primary Secondary Tertiary 16 14 12 10 8 6 4 2 0 2 00 4.1 2 00 4.2 2 00 4.3 2 00 4.4 2 00 5.1 2 00 5.2 2 00 5.3 2 00 5.4 2 00 6.1 2 00 6.2 2 00 6.3 2 00 6.4 2 00 7.1 2 00 7.2 2 00 7.3 2 00 7.4 2 00 8.1 2 00 8.2 2 00 8.3 2 00 8.4 2 00 9.1 2 00 9.2 2 00 9.3 2 00 9.4 Growth was slowing prior to the crisis and rebounded quickly

Massive economic stimulus package Support to enterprises: suspend tax payments social insurance contributions delayed and/or reduced credit expansion wage subsidies Expansion of labor training programs Expansion of safety net programs (esp. rural minimum living standards subsidies) Expanded social insurance coverage (including portable pension and unemployment insurance for migrants)

housing 10% recovery construction 25% rural infrastructure 9% innovations and economic restructuring 9% key infrastructure 38% emission reduction and environmental protection 5% social development 4%

Job vacancy rates fell but bounced back quickly Up to 20 million migrant workers lost jobs temporarily (MOA, NBS surveys) 2/3 of those losing jobs reemployed by summer 2009 (Rozelle et al., 2009) Migrant employment in cities increased by 2.9% from 2008 to 2009 (to 145 million) (NBS) By 2010, very low urban unemployment rates but lower labor force participation (CULS)

Surveyed firms in 8 provinces: 4 coastal provinces (Shandong, Jiangsu, Zhejiang, and Guangdong), one northeast province (Jilin), one central province (Hubei), one northwest province (Shaanxi), and one southwest province (Sichuan). Representative sample of >2000 manufacturing firms in 25 municipalities Sampling frame: all firms who ever had credit relationship with any financial institution Key collaborator: People s Bank of China Research Department

Jun-08 3.03 3.27 2.76 Dec-08 -0.53 0.68 -1.92 Jun-09 2.87 3.20 2.48 All firms Non-exporters Exporters By ownership: State/collective Private Joint/Ltd/Other Foreign By size (#employees) Smallest quartile Second quartile Third quartile Largest quartile -6.05 2.61 3.70 3.84 -0.83 0.99 0.65 -4.55 1.78 5.40 1.70 4.30 2.11 3.00 3.00 3.05 0.48 0.28 0.16 -0.72 3.41 3.20 4.16 2.63 Crisis hit exporters, foreign-invested firms, and larger firms the hardest.

Jun-08 4.76 3.23 5.44 3.51 4.22 2.80 Dec-08 -0.88 -0.07 1.23 0.06 -2.74 -0.27 Jun-09 5.29 2.09 5.71 3.35 5.01 -0.01 All firms Migrants Local Migrants Local Migrants Local Non-exporters Exporters All workers affected by the crisis, but migrants more adversely affected than local workers, especially in exporting firms.

Surplus 5.05 Appropriate 59.86 Deficit 35.09 All firms By ownership: State/collective 35.15 4.55 2.55 1.65 53.26 57.33 69.90 45.36 11.59 38.12 27.55 52.99 Private Joint/Ltd/Other Foreign Still very high labor demand, despite regulations and recent negative shocks. State/collective sector still plagued by surplus labor.

In each of 6 cities, survey 700 local resident households and 600 migrant households In 5 completed cities, surveyed 13,000 adults, including 9000 local residents 5000 migrants 3-stage PPS sampling of urban sub-districts, neighborhoods, and households Detailed enumeration of all dwellings in each neighborhood Surveys directed by CASS, working closely with city Statistical Bureaus

Weekly Working Hours 43.50 43.69 44.88 55.13 55.69 56.98 Monthly Earnings (yuan) 2104 2319 2454 2290 2466 2591 Hourly Earnings (yuan/hour) 11.96 13.12 13.53 10.81 11.61 11.94 Local workers Sep, 2008 Mar, 2009 Feb, 2010 Migrant workers Sep, 2008 Mar, 2009 Feb, 2010

1600 NBS RCRE PBC 1400 1221 1200 1140 1000 953 889 800 821 666 644 756 703 600 2001 2002 2003 2004 2005 2006 2007 2008 2009 NBS=National Bureau of Statistics RCRE=Research Center for Rural Economy (Ministry of Agriculture) PBC=People s Bank of China

2008 42.0 16.3 7.6 2009 39.1 17.3 7.8 Manufacturing Construction Hotels and catering Wholesale and retail trade Transport Other 7.0 7.8 5.6 21.5 5.9 22.1 Units: %. Source: Sheng Laiyun of NBS (2009)

The end of surplus labor? Appeal of the New Socialist Countryside Rising costs of living Looking forward: labor demand and supply Q: Could rising wages be good for China?

Very strict Strict Not strict By period: 2007 21.57 22.46 23.47 24.61 71.12 72.61 72.33 71.34 7.31 4.93 4.19 4.04 Jan-Jun 2008 Jul-Dec 2008 Jan-Jun 2009 By size: Smallest 2nd quartile 3rd quartile 18.32 25.02 22.01 26.40 73.21 70.38 73.66 70.27 8.47 4.60 4.33 3.33 Largest Firms report strict enforcement, with no weakening during the crisis. Smaller firms report less strict enforcement than larger firms.

Robust Std. Err. Dependent variable (ordered probit): 0=very strict, 1=strict, 2=not strict Coef. P>|z| Sector consumer products Sector raw materials Sector capital and equipment Sector other Ownership private Ownership joint Ownership foreign Jiangsu Guangdong Shandong Jilin Hubei Shaanxi Sichuan Exporter Size-quartile 3 Size-quartile 2 Size-quartile 1 Jan-June 2008 June-Dec 2008 Jan-June 2009 0.014 -0.023 -0.156 -0.272 0.108 0.059 0.230 -0.254 -0.078 -0.054 -0.164 0.096 -0.050 -0.538 -0.104 -0.313 -0.352 -0.460 -0.063 -0.077 -0.160 0.065 0.062 0.067 0.084 0.089 0.086 0.096 0.049 0.052 0.056 0.085 0.103 0.074 0.077 0.041 0.051 0.051 0.054 0.048 0.048 0.048 0.828 0.709 0.019 0.001 0.225 0.491 0.016 0.000 0.133 0.330 0.054 0.350 0.505 0.000 0.011 0.000 0.000 0.000 0.190 0.109 0.001 Reference categories: food and beverage state sector Zhejiang Size quartile 4 (smallest size) 2007 Findings: enforcement stricter for: - capital producers - state sector - Sichuan, Jiangsu, Jilin (no strong pattern) - exporters - large firms - most recent period

% yes 34.44 All firms By ownership: State/collective One third of firms report that new Labor Law has influenced employment decisions. Influence greatest for foreign firms, but not much different for exporters and non-exporters. 28.07 31.63 35.40 38.32 Private Joint/Ltd/Other Foreign By export status: Non-exporter Exporter However, preliminary regression analysis finds no relationship between degree of enforcement and actual changes in employment . 34.89 33.51

All Wage employees By gender: 2001 2005 2010 Local 13.4 Migrants 85.7 Local 30.7 22.1 Migrants 85.2 54.7 Local 25.8 24.7 Migrants 53.3 40.1 Male Female 13.7 13.1 85.7 85.8 27.5 35.0 82.7 88.4 24.3 27.8 52.0 54.9 By age: 16~29 30~39 40~49 50~59 60+ 11.6 15.8 14.2 9.22 20.6 80.9 89.2 94.3 92.1 93.9 26.5 34.1 33.8 24.2 37.6 81.7 85.2 91.9 85.5 84.9 21.2 21.5 31.3 27.1 63.2 47.3 53.3 60.9 64.2 75.6 By education: 0~6 7~9 41.4 19.4 12.1 5.0 92.7 87.8 78.4 61.0 68.0 42.5 30.4 18.0 86.8 89.3 83.3 43.5 50.6 44.7 27.9 11.9 78.1 61.4 50.0 23.4 10~12 13+

1. Fixed-term labor contract 2. Open-ended labor contract 3. Other contract (for specific work, labor service company) 4. No labor contract Local residents Male Female 56.22 20.48 Migrants Female 52.1751.26 2.88 Total Male Total 61.2958.3550.46 14.9818.17 4.96 3.98 1.49 1.53 1.50 3.59 2.21 2.94 21.81 22.2021.9741.00 42.7441.82

Incidence (%) Weekly Working Hours 44.88 42.36 51.26 49.52 60.83 48. 54 46.96 65.42 56.98 49.66 62.32 65.89 68.78 56.99 52.22 70.57 Monthly Earnings (yuan) 2454 2769 1659 1186 2124 1486 1452 3340 2591 3229 2127 1840 2277 1855 1912 3724 Hourly Earnings (yuan/hour) 13.53 15.66 8.14 7.02 8.99 7.67 7.77 12.51 11.94 16.36 8.72 7.21 8.57 8.95 8.95 14.96 Local workers Formal Employment Informal Employment 100 71.59 28.41 1.24 7.00 5.48 13.99 0.71 100 42.18 57.82 4.57 26.07 10.80 14.25 2.12 Family workers Self-employment Employee in informal sector Employed informally in formal sector Employer in informal sector Migrant workers Formal Employment Informal Employment Family workers Self-employment Employee in informal sector Employed informally in formal sector Employer in informal sector

Local residents Migrants 1.Do you think that when you are hired your employer should set a labor contract with you? (yes) 2.Do you think employers must pay you double wages for each month you worked beyond the allotted time for completing a labor contract? (yes) 3.If a worker violates the rules set by an employer can the employer terminate the worker s labor contract? (yes) 4.If you meet the required conditions and suggest an open-ended contract, must your employer comply? (yes) 5.Within how long do you think the labor contract should be signed after being hired? (one month) 6.For a one-year labor contract, what is the maximum probationary period? (2 months) Workers are aware of right to a labor contract, but vary in their familiarity with Specific provisions. Migrants and local residents have similar levels of awareness. 96.28 89.66 82.20 79.47 68.83 72.90 68.65 62.77 40.14 41.32 24.54 23.72

2005 2010 Local residents 65.5 74.5 49.1 67.2 18.9 31.8 15.4 4.5 54.4 62.7 28.6 56.3 Migrants Local residents 73.0 77.0 37.7 78.7 26.2 47.2 8.25 7.80 74.7 76.8 43.0 77.9 Migrants Pension 6.1 6.0 5.6 9.2 1.9 2.1 0 0.28 4.2 4.0 0 8.1 19.4 20.0 4.11 20.2 5.75 6.58 0 1.18 47.4 46.9 37.0 33.8 working Unemployed Out of LM Unemployment Ins. working Unemployed Out of LM Health Insurance working Unemployed Out of LM Progress increasing coverage of migrants, and expanding health insurance coverage, (especially to nonworking individuals)

Crisis had very short-term impacts on employment Labor Law is being implemented Viewed as costly by enterprises Trend of increasing informality reversed but no strong evidence of adverse impacts on employment Rising employment and wages Increasing prevalence of labor contracts and social insurance coverage Suggests that robust labor demand is enabling regulatory reform

Labor Law may become increasingly constraining over time Tradeoffs between labor regulation and expansion of formal employment could emerge in future economic slowdowns Increasing labor scarcity will require continued investments to raise labor productivity and enhanced mobility to exploit dynamic comparative advantage