Workforce Challenges and Investment in Technology-Enabled Care in North East England

Discover the workforce challenges and investment opportunities in technology-enabled care in North East & North Cumbria, England. Learn about the strategic plan, economic assets, workforce context, and the regional response to support social care roles.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Technology Enabled Care

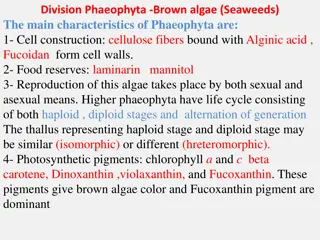

NENC ICS the largest of Englands 42 integrated systems, with 3.2 million people and large geographic footprint. The area is currently sub-divided into four Integrated Care Partnerships (ICPs): North Cumbria, Tees Valley, North of Tyne and Gateshead, and Durham, South Tyneside and Sunderland. North East & North Cumbria Digital & workforce are 2 of six priority workstreams in NENC s strategic plan

High levels of Demand Impact on the wider healthcare system Challenges Demographic Change and Funding constraints constraints Market Risk and Fragility Unpaid carers Workforce Issues in R&R Reform

A Strength-Based Case for Investment We have some significant economic assets (businesses, workforce) that make us important to the region s future economic strategy But we need to invest in technology and housing solutions, and to support the workforce and unpaid carers better, to deliver the vision for ASC Focusing our investment can change the way we meet demand preventing, delaying and reducing need Right-sizing our investment could stretch GVA to 3.7bn - 4.3bn, contribute jobs and stimulate growth in innovation and skills We won t meet current and predicted demand with the existing deficit-based model We already contribute 2.5bn - 3.1bn in GVA We re already spending 1.1bn pa on ASC services in the North East with a further 388m in unmet need

Workforce Context No national workforce plan for ASC, despite the sector employing over 1.6million people in comparison to the 1.4 million employed by the NHS Size and structure of the workforce 600 organization s providing care at over 1,900 locations Vacancy rates increased by 50 % in a year , highest in 6 years NE turnover rates 26% high but consistent Workforce average age 44 & predominantly white & female 34% of registered managers aged 55+ Greatest pressure in recruitment & retention of younger age group Skills for Care Workforce Report 2022

North East Workforce Response The 12 Local Authority areas have made a commitment to fund and support a two-year programme of work looking at deliverables on a regional footprint and the opportunity to work collaboratively and share good practice. A regional recruitment campaign to promote social care roles across the 12 Local Authority areas has launched Development of Care Academies helping to promote and recruit to roles in the independent and voluntary sector. 53% of direct care providing staff who have worked in the sector since 2015, have achieved, partially achieved or are working towards care certificate (recognized national minimum training standards ) Likelihood of leaving your employment decreases if workers had more training Need to recruit younger age group IT literate /education IT based

Regional Vision for Social Care A valued social care workforce where staff are recognised, valued and rewarded Effective workforce planning with investment in career pathways Expansion of the workforce roles which are designed in co- production with people who draw on care and support More care and support in our homes and communities To ensure the effective use of technology and digital opportunities to effectively support the increasing demand for services NE ADASS Workforce Strategy 2022

One solution Virtual House 25% of staff reported confidence in recommending / using digital ADASS regionally commissioned the Virtual House 10/12 LA s signed to build business case by June 2023 Linked in PSW and workforce SLI themed groups Working at scale and doing things once rather than 13 times Received funding from ICS for evaluation Working with 5 Housing providers to pilot with front line staff

Next steps Pilot leading to evaluation and full business case for future investment Future development areas identified E-learning platforms, integral to care assessments, immersive training for complex behaviours Need for targeted learning and development, from basic skills training through to support for digital leaders. Discussion with ICS health & housing colleagues on positive risk approach across health and social care. Building into Market position statement on digital readiness for CQC providers in the NE.