Investigation into University Vice-Chancellors' Remuneration in South Africa

In January 2020, the Minister of Higher Education requested the Council on Higher Education to examine the salaries of Vice-Chancellors and senior executive managers in South Africa. The inquiry looked into various aspects such as salary trends, comparison with staff salaries, governance arrangements, benchmarking practices, performance evaluation mechanisms, international comparability, acceptable remuneration packages, and policy recommendations. The methodology involved data gathering through questionnaires, interviews, and documentation review.

Investigation into University Vice-Chancellors' Remuneration in South Africa

PowerPoint presentation about 'Investigation into University Vice-Chancellors' Remuneration in South Africa'. This presentation describes the topic on In January 2020, the Minister of Higher Education requested the Council on Higher Education to examine the salaries of Vice-Chancellors and senior executive managers in South Africa. The inquiry looked into various aspects such as salary trends, comparison with staff salaries, governance arrangements, benchmarking practices, performance evaluation mechanisms, international comparability, acceptable remuneration packages, and policy recommendations. The methodology involved data gathering through questionnaires, interviews, and documentation review.. Download this presentation absolutely free.

Presentation Transcript

Inquiry into the Remuneration of University Vice-Chancellors and Senior Executive Managers in South Africa Overview Presentation of Final Report Portfolio Committee on Higher Education, Science and Innovation 21 February 2024 1

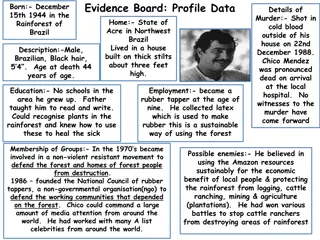

Terms of Reference In January 2020, the Minister of Higher Education, Science and Innovation requested the Council on Higher Education (CHE) to undertake an enquiry into the salaries of Vice Chancellors (VCs) and other senior executive managers and to look at possible measures for regulation. The Terms of Reference for the enquiry included: the annual salaries and increases of VCs and senior executive managers since 2005; how these compare to those of academic and professional, administrative and support staff in universities; administrative and governance arrangements that determine the salaries of VCs and senior executive managers; whether remuneration committees utilise external benchmarks in determining salaries; 2

Terms of Reference (continued) performance evaluation mechanisms, and how they are used to determine VCs salaries and benefits; the relationship between VCs salaries and an array of observable performance indicators; whether the salaries of VCs and senior executive manager are comparable with those in other countries with similar socio-economic contexts; what are deemed to be acceptable VC and senior executive manager remuneration packages; a consistent model by which executive remuneration should be calculated and benchmarked; and the feasibility of a system-wide policy on determining VC and senior executive manager remuneration, taking into account the principle of institutional autonomy. 3

The methodology that was used for the enquiry Five primary data-gathering instruments: A main questionnaire, formulated for online completion by the Chairpersons of all public university Councils (or Administrators) or their delegates, collected information on university structures, policies and procedures related to VC and senior executive remuneration, salary benchmarking and performance management. A second questionnaire, sent using established CHE, DHET, DIRCO and SADC channels, gathered comparable university executive remuneration data from other countries. A structured spreadsheet, sent to Chairpersons or their delegates, requested detailed remuneration data on the total cost to company (TCTC) of individual VCs and senior executives, as well as of academic and professional staff, from 2005 to 2019. Requests for documentation encompassed remuneration and performance management policies, Annual Reports and Council Minutes recording remuneration decisions. Interviews with Chairpersons and accompanying university staff, conducted online, focused on issues arising from submitted data and documentation, as well as on broader issues. 4

Limitations of the enquiry The primary limitation was that the bulk of the remuneration data was self- reported, i.e., supplied by the universities themselves. Nevertheless, wherever possible, all such data was subjected to stringent checking, comparison and verification using DHET data, Annual Report data and statistical testing, as well as information supplied in university documentation and through interviews with university Council Chairpersons and staff. The enquiry focused on the public university sector and did not consider remuneration in private higher education institutions or TVET and CET colleges. The enquiry also did not consider nonetheless important issues of executive pay parity in terms of gender or race. 5

Some challenges that were encountered An enquiry seeking data and information on every component of the remuneration of hundreds of individual university executives over a period of some 15 years faced several challenges: Some universities had not kept, or had lost, or could not retrieve, or withheld, key records (including minutes of Council meetings and remuneration data). A lack of institutional memory was proffered as a reason not to answer certain questions. Considerable delays were caused by some universities having to make extensive corrections to submitted data which the enquiry found and which the institutions belatedly admitted to be incorrect. Instances of poor institutional governance and management and lax financial practices were unearthed at a number of institutions, often involving large financial payments to executives, sometimes repeatedly and over a period of several years, without such payments following established financial and accounting processes and channels. As a result, many of these payments could not be adequately explained or accounted for. 6

International issues in executive compensation Growing public concern that executive compensation may be excessive . Little, if any, connection between executive remuneration and individual or institutional performance, or evidence that high pay promotes high performance. Asymmetric benchmarking behaviour drives increases in VC salaries, with lower-paying institutions trying to keep up with higher-paying institutions. Regulations requiring greater transparency and disclosure of remuneration also ironically fuel increases. VC salaries increasingly benchmarked against the wider corporate sector. Remuneration committees do not always have requisite training or expertise. Reporting on remuneration is not always clear and consistent and sometimes merely an exercise in compliance rather than real accountability. Regulatory mechanisms e.g. formal legislation, policies, tax incentives or penalties, and improved governance are becoming common. 7

Remuneration policies and practices (1) At most universities, VCs and senior executives remuneration packages are decided by a relatively small group of individuals in the form of a Remuneration Committee whose deliberations are not always disclosed to the full Council. Remuneration decisions are guided mainly by (a) formal institutional policies and (b) salary benchmarking data usually supplied by Old Mutual s RemChannel. Most universities believe that their VC and executives are paid less than their counterparts at other universities. Common reasons for paying some senior executives more than others, are these executives experience, scarcity and previous earnings. Most but not all VCs sign annual performance agreements and are formally performance evaluated. At more than a third of universities, the Chairperson of Council singlehandedly conducts the performance evaluation of the Vice-Chancellor. 8

Remuneration policies and practices (2) While remuneration and performance management policies often contain strictures against inferior performance, such poor performance appears seldom, if ever, to result in financial penalties. Universities believe that ex gratia payments to senior executives, which are relatively common, should be better controlled but not dispensed with. Most Chairpersons believe that the regular award of above-inflation increases to VCs and senior executives was justified by the need to compete with other institutions and attract, retain and reward skilled staff. Universities attributed substantial divergences between VC total cost to company (TCTC) figures submitted in response to the CHE s enquiry, and corresponding figures published in their Annual Reports since 2005, to differing reporting requirements, limitations in their accounting practices and the timing of decisions. Not all discrepancies could be explained. Some but not all VCs and senior executives enjoy several fringe benefits which were not always declared such as university houses, vehicles, drivers, security and cleaning staff. In certain instances, universities pay housing fringe benefit taxes on behalf of their VCs. 9

Remuneration policies and practices (3) Almost all universities think that executive remuneration should reflect institutional performance, and that VCs and executives should be rewarded for exceptional, and disciplined for substandard, performance. Few university Chairpersons considered that there was, or should be, any direct connection between VCs TCTC and higher education transformation. One-third of Chairpersons thought that VC and senior executive salaries should be benchmarked against those of the CEOs and executives of private companies. Many universities felt that guidelines would be sufficient to promote better institutional governance of executive remuneration. Most universities were concerned that executive remuneration could become like a runaway train ; and around a third felt that this scenario may already be a reality. 10

The remuneration of Vice-Chancellors In 2019, university Vice-Chancellors average total cost to company (TCTC) was R4 129 835 (median: R3 966 069). The university VC with the highest TCTC was at UJ (R7 166 995) and the VC with the lowest TCTC was at UV (R3 033 988). In 2019, VCs average basic salary was R2 912 846 (median: R2 785 633). The university VC with the highest basic salary was at SU (R4 198 875) and the VC with the lowest basic salary was at VUT (R1 915 565). From 2005 to 2019, VCs median TCTC grew from R1 296 987 to R3 966 069, which is a 206% increase and, when compared with inflation, the real annual increase is 2.41 percentage points on average. From 2005 to 2019, VCs median basic salary grew from R821 185 to R2 785 633, which is a 239% increase and, when compared with inflation, the real annual increase is 3 percentage points on average. VCs have thus been receiving real increases over these years. 11

TCTC of VCs in 2019 UJ R7,166,995 UNISA R5,266,198 SU R5,225,685 UZ R4,825,185 UL R4,649,332 WITS R4,577,000 UCT R4,394,701 UKZN R4,388,266 TUT R4,319,572 UFS R4,138,790 DUT R4,058,023 UMP R4,054,527 SPU R4,036,962 NWU R3,895,177 CUT R3,869,681 UP R3,817,648 SMU R3,799,270 NMU R3,790,252 UWC R3,782,237 CPUT R3,677,327 RU R3,527,936 MUT R3,428,000 VUT R3,411,766 WSU R3,123,011 UFH R3,118,179 UV R3,033,988 12

The remuneration of senior executives From 2005 to 2019, senior executives (i.e., P2 and P3 combined) median basic salary grew from R524 278 to R1 617 733, which is a 208% increase and, when compared with inflation, the real annual increase is 2.47 percentage points on average (which is close to the 3 percentage point increase reported for VCs over the period). Like VCs, senior executives have thus been receiving real increases over these years. There are significant differences, variations and fluctuations, within and between universities, in the number of P2 and P3 senior executive posts, with a substantial proliferation of new job titles in each category since 2005. In 2019, UP had the largest number of P2 senior executives (17), and UNISA had the largest number of P3 senior executives (35). In 2019 there were, on average, 4 P2 posts and 7 P3 posts per university. There are large differences between the lowest and highest TCTC of both P2 and P3 senior executives within institutions. 13

Executive remuneration vis--vis other staff VCs receive on average: 1.4 times more than P2 senior executives; 1.7 times more than P3 senior executives; 2.2 times more than P4 senior professors; 2.3 times more than P5 professors; 4.1 times more than P8 lecturers; 6.6 times more than P9 junior lecturers; 2.3 times more than P4 senior directors; 6.2 times more than P8-P10 senior administrators; 8.5 times more than P11-P12 administrators; and 12.3 times more than P13-P16 general workers. The remuneration of executive and other senior staff (P5 and above) is thus much more closely aligned with the remuneration of VCs than is the remuneration of other academic and professional staff. 14

Ratios of VCs' TCTC to university staff's highest TCTC in 2019 15

Some national and international comparisons In terms of both basic salary and TCTC, university VCs are generally paid better than the CEOs of most science councils. Considering the average TCTC, in 2019, VCs were paid on average nearly R700 000 more than their counterparts at the science councils. When considered in US dollar purchasing power parity terms (PPP), the average TCTC of South African VCs compares favourably with VCs in some developed countries, being second highest when compared to Australia (highest), and higher than their counterparts in the UK, Canada and New Zealand. 16

VC remuneration vis--vis institutional performance The enquiry found: no clear links between the basic salaries and performance bonuses paid to VCs and their management of university enrolment planning; no clear and definitive correlations between a VC s basic salary and the financial management and health of their university; and no strong or statistically significant correlations between a VC s TCTC or basic salary and the knowledge productivity (research publications, and Masters and doctoral graduates), capacity (size of professoriate, and number of PhDs) or intensity (postgraduate enrolments, and third-steam income) of their institution. 17

Some instances of concern Three instances of significant concern were as follows: The University of Johannesburg kept no records of decisions regarding, and failed to report annually or properly account for large payments paid for performance bonuses (e.g R4 055 035 in 2016), deferred compensation (e.g. R4 392 135 in 2016 and R12 800 000 in 2017) and other incentives and benefits paid to a former VC over a period of several years. After a limited investigation, which did not cover the VC s full term of office, some of this money was recovered from the VC and outstanding taxes were paid to SARS, but the bulk was written off or not recovered. o The University of Limpopo paid a large amount of R3 745 000 to its VC in 2017 to rectify lost benefits , because he had apparently not utilised certain perquisites (including a university house and private staff) which, for years, had been available to him, as well as an amount of nearly R1.5m in leaveencashment in 2018. This VC was thereafter immediately re-appointed on a five-year post-retirement contract with little difference to his remuneration arrangements. o The University of Pretoria failed to divulge fully (and partly misrepresented what it did divulge regarding) millions of Rands paid to its executive managers in retention agreements. These agreements twice included large payments intended to retain the services of a VC (R3.5m in 2009 and R7.7m in 2014) who, despite receiving, in addition, a very generous remuneration package, left the institution anyway and was nevertheless permitted, rather dubiously, both to keep the retention payments and take up full-time employment elsewhere, as long as she returned (as a professor). o The enquiry also identified instances of poor corporate governance and lax financial practices at several other universities. 18

Conclusions VCs and senior executives generous remuneration packages and spiralling above-inflation increases have been facilitated by weak institutional governance and accounting practices, including decisions made by limited numbers of university Councillors on the basis of selective and sometimes problematic assumptions. Large executive remuneration and the practices which abet them, where these exist, cannot be defended either morally or economically. While not all university executives are overpaid, and some institutions are managing executive remuneration well, the university sector s efforts at self-regulation over the past 15 years have been limited and inconsequential. The lack of regulation, both internal and external, regarding executive remuneration threatens to undermine institutional autonomy. The substantial inconsistencies, extreme variations and increasing divergences in executive remuneration, at once within and between institutions and within and between Peromnes levels, suggest that internal and external guidelines and policies are inadequate and insufficiently monitored. Given these conclusions, the report recommends greater external and institutional oversight and more regular scrutiny, improved institutional governance, accounting and reporting practices, and strengthened and more developed policy frameworks, with respect to executive remuneration.

Recommendations for the Minister and the DHET The reporting of executive remuneration in university Annual Reports must be made more detailed, comprehensive and comparable, and standardised; DHET monitoring of such reporting must be enhanced; the Auditor-General should be requested to oversee the external auditing companies employed by each university, as is the practice for other public entities in the sector; guidelines and policy frameworks should be developed and strengthened with an eye to capping executive remuneration, specifying ratios between Peromnes and other employment categories with regard to remuneration, limiting annual increases for executives and/or subjecting all executive incentives to clawback ; private salary benchmarking companies should be encouraged to assist government s efforts to improve oversight of executive remuneration; private higher education institutions should annually publish and provide the DHET with specified executive remuneration information; and further research should be conducted to (a) investigate, utilising national cohort study and other data, all possible relationships between university executive compensation and institutional performance, and (b) investigate university Council members emoluments, roles, activities, expertise, qualifications and experience with regard to overseeing executive remuneration. 20

Recommendations for university Councils Institutional governance and accounting practices must be improved, including making changes to the composition of university Councils and Council sub-committees with regard to the length of service of Council members, the number and duration of membership of Council members serving on sub-committees and their qualifications, experience and expertise, and eligibility criteria for nomination and election to Council positions, as well as improving financial record keeping and minuting of decisions and enhancing individual Councillor induction, development and training; all Council sub-committee decisions related to any aspect of executive remuneration should be fully minuted, archived and reported to both the full Council and the DHET; all university Council members, including Council Chairpersons, should be subjected to annual performance evaluations; executive remuneration should be linked directly and explicitly to the imperatives of higher education transformation, development and sustainability; and the remuneration of all university staff (and not just executive staff) ought to be linked to performance and subjected to performance appraisal. 21

Recommendations for the CHE Following the release of the report, the CHE should initiate a broad, inclusive and intensive six-month consultation process with all higher education institutions and relevant stakeholders, aimed at developing guidelines to manage executive remuneration better; The CHE should advise the DHET and the Auditor-General on issues where university institutional governance and accountability intersect with the use of public resources; The CHE should appoint, at suitable intervals and where funding permits, an independent committee to conduct performance evaluations of all university Council Chairpersons and report its findings to the Minister; and The CHE should conduct an investigation, similar to this enquiry, into executive remuneration at private higher education institutions in South Africa. 22

Thank You 23